In the bible we read about a time in the future where the Antichrist will take control of the world. The centerpiece of that system will be our access to money. Here’s what the bible says on the matter. We read about it in the book of Revelation chapter 13:

And I beheld another beast coming up out of the earth; and he had two horns like a lamb, and he spake as a dragon.

12 And he exerciseth all the power of the first beast before him, and causeth the earth and them which dwell therein to worship the first beast, whose deadly wound was healed.

13 And he doeth great wonders, so that he maketh fire come down from heaven on the earth in the sight of men,

14 And deceiveth them that dwell on the earth by the means of those miracles which he had power to do in the sight of the beast; saying to them that dwell on the earth, that they should make an image to the beast, which had the wound by a sword, and did live.

15 And he had power to give life unto the image of the beast, that the image of the beast should both speak, and cause that as many as would not worship the image of the beast should be killed.

16 And he causeth all, both small and great, rich and poor, free and bond, to receive a mark in their right hand, or in their foreheads:

17 And that no man might buy or sell, save he that had the mark, or the name of the beast, or the number of his name.

18 Here is wisdom. Let him that hath understanding count the number of the beast: for it is the number of a man; and his number is Six hundred threescore and six.

Worshipping the beast and accepting his mark in order to buy and sell has dire consequences. We read about that in the book of Revelation chapter 14:

And the third angel followed them, saying with a loud voice, If any man worship the beast and his image, and receive his mark in his forehead, or in his hand,

10 The same shall drink of the wine of the wrath of God, which is poured out without mixture into the cup of his indignation; and he shall be tormented with fire and brimstone in the presence of the holy angels, and in the presence of the Lamb:

11 And the smoke of their torment ascendeth up for ever and ever: and they have no rest day nor night, who worship the beast and his image, and whosoever receiveth the mark of his name.

First a short disclaimer, and then I will explain my theory on how this beast system might be put in place. Bible prophecy is veiled. It is not for everyone to know the meaning of these prophecies. Prophecy uses symbols for example, and cryptic language when speaking about the things to come. Understanding these prophecies requires discernment, and equally important, it requires the assistance of a scholar - a man or woman who studies the bible, who has a foundational depth of understanding of the bible and is therefore capable of putting the pieces of the puzzle together. And I believe it requires the assistance of the Holy Spirit. These words from Paul make the point. We read these words in 2 Corinthians chapter 3:

We are not like Moses, who would put a veil over his face to prevent the Israelites from seeing the end of what was passing away. 14 But their minds were made dull, for to this day the same veil remains when the old covenant is read. It has not been removed, because only in Christ is it taken away. 15 Even to this day when Moses is read, a veil covers their hearts. 16 But whenever anyone turns to the Lord, the veil is taken away. 17 Now the Lord is the Spirit, and where the Spirit of the Lord is, there is freedom. 18 And we all, who with unveiled faces contemplate the Lord’s glory, are being transformed into his image with ever-increasing glory, which comes from the Lord, who is the Spirit.

Correlating the signs of our time with biblical prophecy.

First a little background. I have been a market analyst for over 50 years now. In that capacity I need to have a foundational base of knowledge about the markets, and I do. I understand our money system and how it works. I understand how money is created and how it is destroyed. I understand how countries can amass huge levels of debt and continue to function. I understand the role the United States plays on a global scale with regard to international trade. I understand the dollar’s role in global trade. I understand the various metrics we use to monitor the economy - things like GDP, CPI, debt to GDP ratios, inflation, deflation, the Federal Reserve Bank’s role in controlling the economy, and how the United States is the base of economic power in the world.

That knowledge gives me an advantage over at least 95% of the population, and I would guess that number might be higher than 95%. It is not a matter of boasting. It is simply a fact that a person who has spent the better part of his life in this arena will know a lot more than those who haven’t. It is not an easy subject to master and only a few in relative terms manage to do so. Henry Ford made a comment that speaks to the complexity of this system we operate under:

It is perhaps well enough that the people of the nation do not know or understand our banking and monetary system, for if they did I believe there would be a revolution before tomorrow morning.

I offer that information only to let the reader know my qualifications for writing this paper. I may be wrong of course in terms of my theory, but there is ample evidence suggesting the theory is plausible if not probable.

Bible prophecy tells us we will see the beast system put in place, and those who want to buy and sell will have to do so via the beast system. And today we are seeing a massive realigning of our money system. Those in control want to enslave the masses after all, and there is ample support for that view. Consider for instance the vaccine passports from a few years back. They - and by “they” I mean those in control - decided vaccine passports would be a good idea. Your travel would be severely restricted unless you got the vaccine and could prove it by carrying a vaccine passport. That idea was met with massive resistance by the people and so it never got off the ground, but they certainly floated the idea to the public.

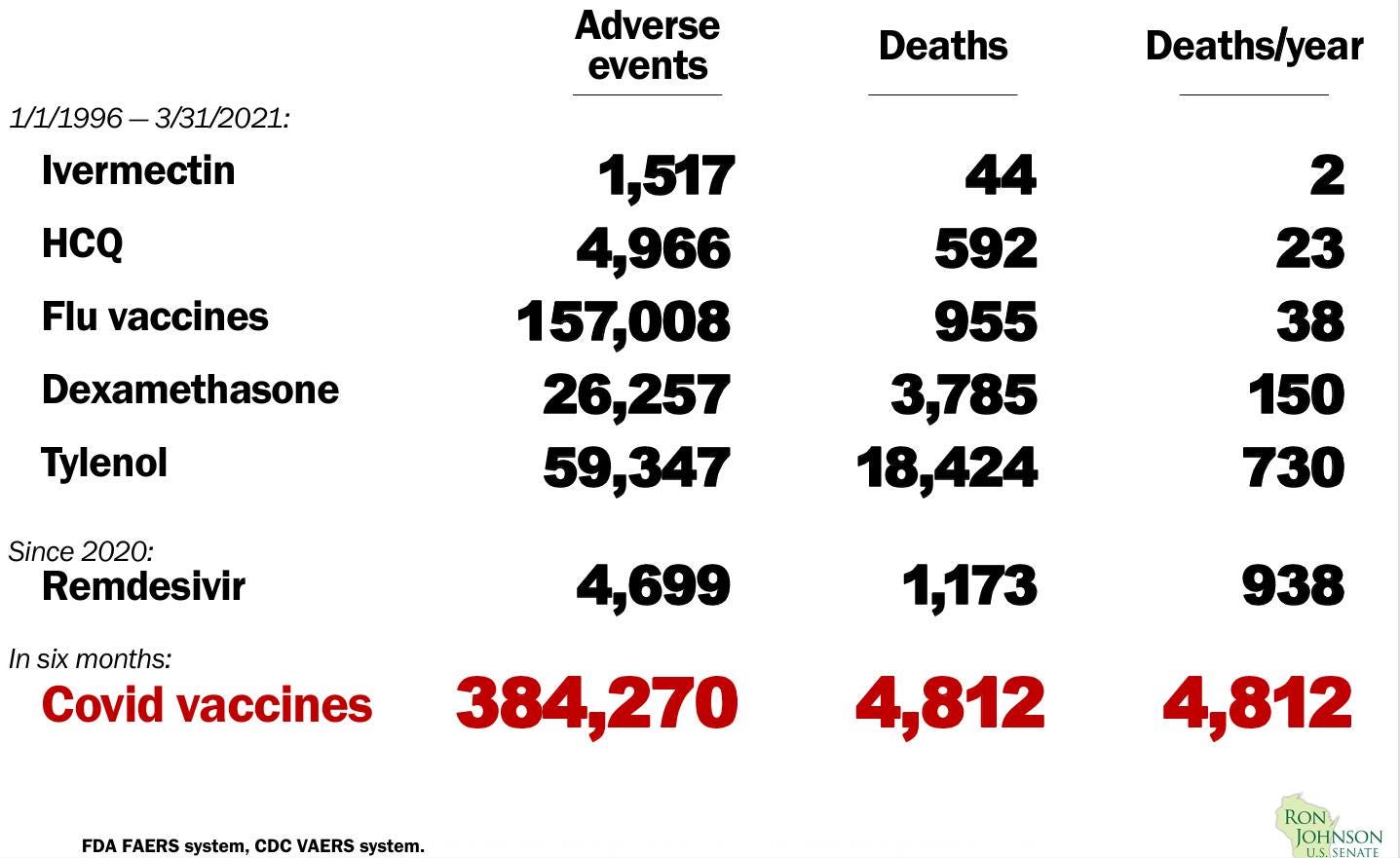

If you can’t accept the idea that “they” really don’t have your best interest in mind with these sorts of policies, you might not agree with my points in this paper, but keep in mind we did in time learn that the Covid vaccine didn’t prevent a person from contracting Covid or transmitting it. And more to the point, the vaccines have over time been proven to be genuinely dangerous to one’s health. Consider this graphic of vaccine adverse events from CDC (Center for Disease Control) data:

One might also consider a patent application Bill Gates filed in 2019. The patent number is WO/2020-060606 A1. Here is what the Abstract for that patent states:

Abstract

Human body activity associated with a task provided to a user may be used in a mining process of a cryptocurrency system. A server may provide a task to a device of a user which is communicatively coupled to the server. A sensor communicatively coupled to or comprised in the device of the user may sense body activity of the user. Body activity data may be generated based on the sensed body activity of the user. The cryptocurrency system communicatively coupled to the device of the user may verify if the body activity data satisfies one or more conditions set by the cryptocurrency system, and award cryptocurrency to the user whose body activity data is verified.

Should it cause one to raise his eyebrows when looking at the patent number for Gate’s crypto patent? The number 666 is after all the number of a man per the bible:

Here is wisdom. Let him that hath understanding count the number of the beast: for it is the number of a man; and his number is Six hundred threescore and six.

I don’t really think Bill Gates is the Antichrist by the way, but I do find it interesting that this patent has to do with rewarding people with crypto currency for doing certain things, and of course the patent number itself does cause one to take pause.

And one might give some thought to a stablecoin (a type of crypto currency) bill introduced in the Senate earlier this year. The bill was introduced by U.S. Senators Cynthia Lummis and Kirsten Gillibrand. Consider these words from an article on the matter titled U.S. Senators Lummis, Gillibrand Take on Stablecoin Legislation With New Bill:

The bill created a $10 billion limit for non-depository trust institutions to be able to issue payment stablecoins. Once the issuer exceeds that amount, it must be "a depository institution that has been authorized as a national payment stablecoin issuer," the bill's text said.

All this is relevant to my theory. It shows we are moving ever closer to a system of payments that will incorporate a compliance regimen into the system. This bill is defining the regulatory framework for the issuance of stablecoins by non-depository trust institutions.

What are stablecoins?

Stablecoins are defined as follows:

Tether (USDT) is by far the most popular of these stablecoins in today’s market. Tether is a private company with wide acceptance in the crypto world. The price of a Tether stablecoin doesn’t fluctuate much - in other words its value is relatively stable. That means they don’t offer a lot of value in terms of investments. They are pegged to the US dollar and consistently hold a value of one US dollar for one Tether.

A good question would be this - why do we need Tethers? Well, actually we don’t need them, but we do have them. Tether’s market cap is approximately $139 billion, and the daily trading volume of Tether’s typically exceeds market cap. Trading volume in Tethers today is $204 billion at 11:00 am standard time.

The way one acquires a Tether is to pay for it with US dollars. When that transaction takes place something interesting happens. Tether - the company - gets your dollars and you get their Tethers. What can you do with a Tether? You can hold it, or you can use it to buy cryptos like Bitcoin or Ethereum. What can Tether do with the dollars you gave them? Well, they can hold them or invest them, say in Bitcoin. The Bitcoin they might buy would be reserves that back the Tether’s they issued.

Pretty neat sleight of hand trick, isn’t it? Tether - the company - starts out with nothing and ends up with investible capital that is worth in today’s market about $139 billion.

Now to the matter of my theory. It gets a little more complicated from here.

Let’s start with the Bretton Woods agreement. That agreement was put in place at the end of World War II and made provisions for the way in which international trade would be conducted. The US dollar would be the currency used between countries when buying or selling goods to one another. The US agreed that dollars would be backed by gold at the rate of $35 per ounce. The dollar became the world’s reserve currency.

A precursor to Bretton Woods was the Executive Order issued by FDR that resulted in the confiscation of all gold held by citizens at a rate of $20.67 per ounce in 1933. In 1971 President Nixon officially declared the US was reneging on its promise to redeem dollars in gold and in 1974 Gerald Ford repealed the executive order allowing citizens to once again own gold.

Since being the possessor of the world’s reserve currency was so advantageous to the United States, and the reneging of the Bretton Woods promise to redeem dollars in gold was no longer on the table, the United States made a deal with Saudi Arabia whereby the Saudis agreed to conduct all oil sales in US dollars and the petrodollar system began. The result - the US dollar remained the world’s reserve currency.

To conduct trade between countries the buyer of goods had to have US dollars, and the seller of goods had to accept US dollars. This arrangement had many benefits to the United States. As the issuer of the world’s reserve currency, the US had to provide dollars for its citizens in the US, but also countries around the world for the purpose of conducting international trade.

Since money is created under the fractional reserve system by borrowing it into existence, the United States began to run ever larger levels of debt.

The US was able to expand debt but since so much of the money supply was held in US dollar debt assets overseas the impact on the domestic economy was negligible. Foreign countries could sell their dollars and buy their domestic currency if they wanted to, but countries that were net exporters didn’t want to as doing so would apply downward pressure to the dollar and upward pressure to their own currency.

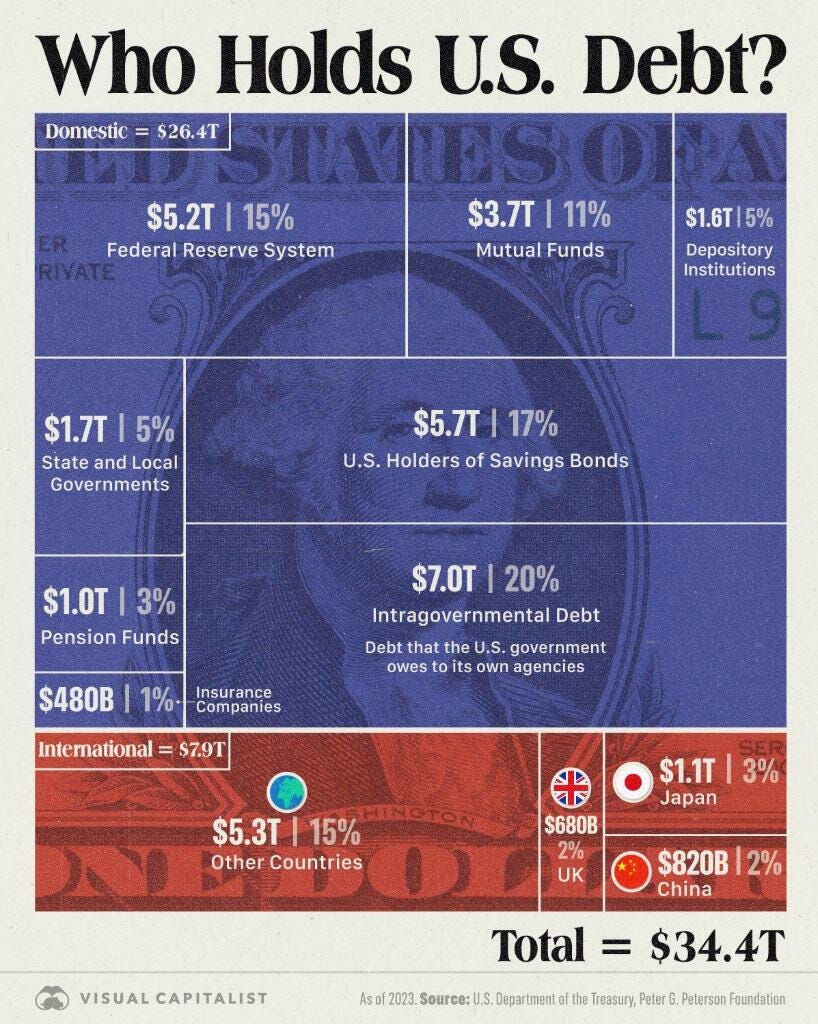

The effect of that would mean that more dollars would be required to buy the exporters goods and so demand for those goods would be curbed by the amount of dollars a buying country had in its possession, and that amount of dollars would be a function of an exchange rate between the countries sovereign currency and the US dollar. The stronger the dollar the less their domestic currency could buy. So, for a net exporting country the logical alternative was to exchange non-interest-bearing dollars for interesting bearing US treasuries. As the graphic below shows about 20% of US debt is held by foreign countries and the reason this is so has to do with the US dollars status as the world’s reserve currency.

So, to my theory. It’s not really mine by the way. I’m just an observer, but what I observe is a move toward crypto currency as a novel new idea for how to back our national debt. Acceptance for Bitcoin and other cryptocurrencies has increased dramatically in the last few years. Those who were opposed to crypto a few years ago are now embracing crypto.

I first noticed this shift in late 2020. That is when I began to recommend Bitcoin as a good investment and perhaps the best investment one could make. My logic was simple enough. Our debt levels took off for the moon in response to the Covid shutdown, and that was certain to bring about high rates of inflation. The quantity of Bitcoin was locked in at a maximum of 21 million. If Bitcoin was a legitimate form of currency and it wasn’t possible to increase supply, then increasing the supply of dollars would necessarily drive the price of Bitcoin priced in dollars much higher, and that is exactly what has happened. No asset class I am aware of has increased the way Bitcoin has increased. The chart below shows that to be true.

Make no mistake on this point - as a class, the super wealthy gained a lot as a result of the fiscal policy put in place to bring us out of the worst recession since the Great Depression. The Covid shutdowns were insane moves unless your goal is to get buy-in from the people on why they should conform to dystopian rules that are necessary to “protect us.”

The loss of the dollars purchasing power since Covid is dramatic, and it was the result of massive levels of money creation via federal borrowing. They used a false flag pandemic to create a financial crisis after all, and it wasn’t the result of incompetence. Their plan goes like this - create a problem and then offer a solution that will make the original problem go away.

Here’s the problem though. There was a lot of pushback by some people from the beginning of the Covid hysteria in 2020. They - they in this case being the ones pushing this agenda on the people - were met with a lot of resistance to the shutdowns, masks, social distancing and vaccines. Some doctors spoke out and some scientists spoke out and some biologists spoke out and some people listened to them. More to the point - there just weren’t that many people dying. Less than 1% and almost all of them were old or had comorbidities. In other words, people were dying with Covid - not because of Covid. And, finally, there wasn’t really any way to enforce the Covid mandates. There were enough people who refused to get the vaccine to fill the jails and prisons in the United States multiple times over. The Covid pandemic was most assuredly a Beta test to determine voluntary compliance, and once it was evident the levels of voluntary compliance didn’t meet expectations the whole plan was abandoned.

Conspiracy theorists will no doubt tell us they will use the same plan again - that a new pandemic will surface. I don’t think so. They just don’t run the same play time and again. But they do intend to enslave us - to make us dependent on them for our very survival, and they will succeed in doing so. I know that because the bible tells us that, and the bible just doesn’t get these prophecies wrong.

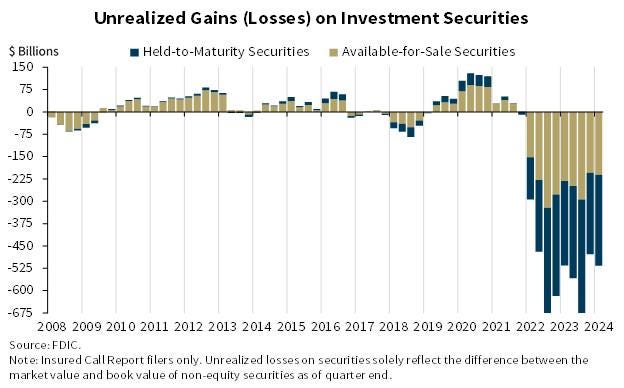

The bible also tells us how they will succeed in doing that. The answer - control our money. To gain control of our money they need to destroy the existing system and replace it with a new system. If you understand money and markets like I do you know they are doing all they can to destroy our current system. Consider fiscal policy. In the last 15 years our federal debt levels have grown by 400% from $9 trillion to $36 trillion. Or consider the monetary policy of the Federal Reserve. By raising short term interest rates - the Fed Funds rate - they have impacted the value of the assets banks hold - impacted them a lot. A bonds value is determined by the fixed rate of the bond relative to the current rate of a new bond. A 20-year bond yielding 2% 3 years ago is worth a lot less than one yielding 5% today. This chart courtesy of the Federal Deposit Insurance Corporation tells the story:

The majority of banks today are not solvent and would be unable to withstand a run on the bank. In other words, they don’t have enough assets to cover liabilities, and their liabilities are your deposits. The Federal Reserve has created that condition and to suggest they don’t know that is absurd. A run on the bank won’t happen until they make it happen though. They ran a Beta test on that too back in 2023 with Silicon Valley Bank. Investopedia explains why the bank failed in these comments:

Silicon Valley Bank saw massive growth between 2019 and 2022, which resulted in it having a significant amount of deposits and assets. While a small amount of those deposits were held in cash, most of the excess was used to buy Treasury bonds and other long-term debts. These assets tend to have relatively low returns but also relatively low risk.

But as the Federal Reserve increased interest rates in response to high inflation, Silicon Valley Bank’s bonds became riskier investments. Because investors could buy bonds at higher interest rates, Silicon Valley Bank’s bonds declined in value.

As this was happening, some of Silicon Valley Bank’s customers—many of whom are in the technology industry—hit financial troubles, and many began to withdraw funds from their accounts.

Why Silicon Valley Bank? They were mostly invested in what is deemed to be super safe US treasuries, and in fact, until the repeal of Glass Steagall a little over 20 years ago that was all they were allowed to invest in. Bottom line - Silicon Valley did nothing wrong but the Federal Reserve did. They raised the Fed funds rate in a very short window of time to an unprecedented level in percent terms.

The chart above shows two periods where the Fed went a little crazy. The first one was in the late 1970’s. The Fed doubled the rate from around 10% to 20% - an increase of 100%. The other one is the most recent one. The Fed went from 1/10th of a percent to 5.33% in 2 years - an increase of over 5000% in just two years. To suggest they didn’t know the impact such a move would have on bank solvency is absurd.

The ostensible reason for doing that was to slow down inflation - inflation that was the result of an insane response to a false flag pandemic that drove federal debt levels up to heights never seen before in percent terms as well as nominal dollar terms.

One could use the Hegelian dialectic to explain how that worked. Hegelian dialectic involves a thesis, its antithesis, and a synthesis. If one were to employ this concept for evil, we could say the evildoers create a problem, proposes a solution which makes things worse, and then a final solution - the one the evildoers wanted in the first place.

That is in fact what has taken place since 2020. The final synthesis is to introduce the new system - perhaps as the result of a bank run promulgated by those who want to see this new system put in place.

A new system evolves in response to a banking crisis

It is a fact the large majority of banks today are technically insolvent. The Federal Reserve could ameliorate that problem easily, but they won’t do that. They could lower interest rates by lowering the Fed Funds rate. As interest rates came down the value of debt instruments held by banks would go up and the banks would move ever closer to solvency once again. It is a point you won’t hear anyone talk about by the way. The whole focus on interest rate policy is inflation. The Fed argues that high rates of interest curb borrowing and that slows down the rate of money supply growth and money supply growth without a commensurate increase in GDP is inflationary.

The reason used for keeping interest rates high is an ostensible reason - not the real reason, but rather the reason offered to the people as a sort of subterfuge. It is a reason well-grounded in economic theory by the way, but as a practical matter debt is increasing in spite of higher interest rates - both in the public arena and the private sector. People are using debt to maintain lifestyles as inflation is continuing to be a burden and the federal government is using debt to support GDP as consumers are not able to do so on their own even when resorting to ever increasing debt loads.

As a matter of fact, the Fed’s interest rate policy is not in any way solving the problem of inflation, but it is setting the stage for a collapse of the banking system. All that is required is for those who are trying to implement this new system to hand a new script to their media puppets - a script that sounds a new warning. The warning - the banks are insolvent and don’t have enough money to cover customer deposits. That warning by the way would be legitimate as they don’t have enough money to cover their deposits, and that is the result of the Federal Reserve’s interest rate policy.

An interesting side note to all this is the policy the Fed put in place after the Silicon Valley collapse. The Fed agreed to loan banks money against the bonds they held at par value rather than market value. That policy, allowed to remain in place, would have prevented a collapse of the banking system as the bank’s asset holdings would be adequate to meet depositor demands. This statement found on the Federal Reserve’s website explains the plan and also states the plan came to an end in early 2024:

The Bank Term Funding Program (BTFP) was created to support American businesses and households by making additional funding available to eligible depository institutions to help assure banks have the ability to meet the needs of all their depositors. The BTFP offers loans of up to one year in length to banks, savings associations, credit unions, and other eligible depository institutions pledging any collateral eligible for purchase by the Federal Reserve Banks in open market operations (see 12 CFR 201.108(b)), such as U.S. Treasuries, U.S. agency securities, and U.S. agency mortgage-backed securities. These assets are valued at par. The BTFP is an additional source of liquidity against high-quality securities, eliminating an institution’s need to quickly sell those securities in times of stress.

The BTFP ceased extending new loans on March 11, 2024.

Why would the Fed discontinue this solution to a systemic problem they created in the first place? My answer - the Fed is not a part of the solution to the problem, but rather the one who created the problem in the first place, and because they are the ones at the center of a plan to collapse the existing system and roll out a new system - a programable digital currency.

One must never forget the importance of offering ostensible reasons for actions taken by those who want buy-in to a plan by the people. Ostensible reasons are reasons that are not true but offered to get people on board with a plan. The plan under the Covid false flag was to see if they could get people to do as they were told and mask up, shut down businesses, get the vaccine, etc. If a large percent of the people refused to do so there was little they could do and so they abandoned that plan. It was a matter of “if I refuse what are you going to do?” That is a much different outcome than collapsing the banking system and ushering in programable digital currencies. In that case the matter changes - it is no longer what are they going to do if you resist, but rather what are you going to do when they tell you your assets - bank accounts - are gone and they are being replaced with a programable digital currency. If you want to buy and sell goods and services, you are going to accept their new system as you have no choice.

Ah, but to do that and agree to use their system, if you believe the bible, is to make the most critically important decision of your life. This is what the bible says in case you forgot:

And the third angel followed them, saying with a loud voice, If any man worship the beast and his image, and receive his mark in his forehead, or in his hand,

10 The same shall drink of the wine of the wrath of God, which is poured out without mixture into the cup of his indignation; and he shall be tormented with fire and brimstone in the presence of the holy angels, and in the presence of the Lamb:

11 And the smoke of their torment ascendeth up for ever and ever: and they have no rest day nor night, who worship the beast and his image, and whosoever receiveth the mark of his name.

Rolling out programable digital currencies after collapsing the current system is the plan under my theory. I don’t know what restrictions will be put in place regarding the use of this new form of money, but there will be restrictions. The goal is simple - make your very existence fully dependent on those at the top. In other words, you - the slave - are dependent for your existence on the master’s benevolence. Sustainable Development Goals will be at the heart of the matter. There are 17 of them, and you can read about them here: 2030 agenda and the sustainable development goals. These goals do have a nice ring to them after all. They are couched in words that most people would find appealing but remember my warning - ostensible reasons always sound better than the real reasons for implementing a new plan. Peace on earth and goodwill toward man has a nice ring to it after all - much better than saying my plan is to make you my slave and make you totally dependent on me for your very existence.

If you think I am engaging in hyperbole you can read about programable currencies on the Federal Reserve’s website: Programable Money. If it’s a little more than you want to take on at this point let me share with you the opening paragraph:

Discussions of financial technology have recently started to include the idea of "programmable money," though the specific meaning of the term is often unclear. Different perspectives may presume a particular underlying technology or set of features to be a part of a programmable money system, and lack of agreement on these aspects may lead to confusion. To support clearer discussion of this concept in the central banking community and the financial industry more broadly, this research note offers an investigation into the nature of programmable money. This note focuses on the importance of a mechanism guaranteeing the inseparable functionality of the technical components of a programmable money system rather than prescribing the specific nature of those components. This "coherence guarantee" is crucial regardless of specific technical choices and admits a wide range of potential designs for programmable money. The guarantee also facilitates the view of programmable money as a concrete product, which may provide users with greater certainty about its nature and capabilities than alternative service-oriented models that can automate interaction with particular digital value records.

If you bothered to read that you probably wasted your time. What does it say? Not much of value at all. When you read narratives of this sort you’ve got to know the truth of the matter is not contained in those words. What you can know though is the Fed is promoting the implementation of digital programable currencies, and you can know that by reading the last sentence.

On to the matter of the great taking - you will own nothing, and you will be happy.

David Webb wrote a book titled the Great Taking. The link below allows you to download the PDF of this book for free. Webb is on a mission to inform the public about a section of the Uniform Commercial Code that allows financial intermediaries to take the assets of the people in the event of financial insolvency of the intermediary. The opening statement in the download link above states the following:

You are invited to read or download The Great Taking, a book written about the scheme of central bankers to subjugate humanity by taking all securities, bank deposits, and property financed with debt.

Here’s the link to the PDF format of the book. It is free by the way as Webb clearly has no desire to gain financially from his work. Rather he is one of those rare individuals who just cares about others and wants to make them aware of what is going on outside the view of the public, and pretty much outside the view of our government bureaucracy as well: The Great Taking PDF link.

I think it is useful to share with you a few comments Webb makes in his introduction:

What is this book about? It is about the taking of collateral, all of it, the end game of this globally synchronous debt accumulation super cycle. This is being executed by long-planned, intelligent design, the audacity and scope of which is difficult for the mind to encompass. Included are all financial assets, all money on deposit at banks, all stocks and bonds, and hence, all underlying property of all public corporations, including all inventories, plant and equipment, land, mineral deposits, inventions and intellectual property. Privately owned personal and real property financed with any amount of debt will be similarly taken, as will the assets of privately owned businesses, which have been financed with debt. If even partially successful, this will be the greatest conquest and subjugation in world history. We are now living within a hybrid war conducted almost entirely by deception, and thus designed to achieve war aims with little energy input. It is a war of conquest directed not against other nation states but against all of humanity.

Private, closely held control of all central banks, and hence of all money creation, has allowed a very few people to control all political parties, governments, the intelligence agencies and their myriad front organizations, the armed forces, the police, the major corporations, and of course, the media. These very few people are the prime movers. Their plans are executed over decades. Their control is opaque. When George Soros said to me, “You don’t know what they can do,” it was these people to whom he referred. Now, to be absolutely clear, it is these very few people, who are hidden from you, who are behind this war against humanity. You may never know who they are. The people you are allowed to see are hired “face men” and “face women.” They are expendable.

One might seek comfort in thinking that this must be crazy; nothing like this has ever happened before ... but it has. The precedent for the intent, design and horrific execution of such a plan can be found by examining the early 20th century, the period of the great wars and the Great Depression. The proclaimed “Great Reset” now in progress, however, includes major innovations, which will allow unprecedented concentration of wealth and of power over humanity through deprivation. How might it come to pass that you will own nothing, as so boldly predicted by the World Economic Forum? It certainly is not about the personal convenience of renting.

I by no means want to suggest I am on par with David Webb, but I will say everything he talks about in the documentary resonates with me. We are kindred souls in the matter of our quest for gaining a deep understanding of how markets work. I pay little attention to the rhetoric of market mavens. I need to look at the data, run correlation coefficients on different data sets, give due consideration to things that don’t make sense - for example the Federal Reserve’s interest rate policy that virtually guaranteed bank insolvency - and in general operate on the basis that there are things going on behind the scenes that are agenda driven - driven by people out of the public eye who can make things happen. It’s a rigged game and my goal is always to see just exactly how it is rigged so that I can know what happens next. I’ve also echoed Webb’s sentiments regarding the major players in this rigged game. We don’t know who they are, but they are not the ones we might think. They are not the Clinton’s, the Obama’s, the Trump’s, or any of those people in government - either the elected officials or the bureaucratic swamp creatures that run the various 3 letter agencies that do the bidding of the ones in control. They are people with power - power they possess as the result of their wealth, and most of them are probably not listed on the Forbes wealthiest people list.

My brief foray into publishing my work on markets started in 2012. I was shocked to find it was so easy for me to gain recognition for my work. Perhaps the most comprehensive piece I ever published was an article titled Anatomy of a Market Bubble.

That article was chosen as an Editor’s Pick. I created around 20 charts and tables myself as the data I wanted to present wasn’t available in chart form. The article was really long and resulted in a lot of back-and-forth comments from very knowledgeable investors. There were 541 comments on that article. I mention that only to explain how I think, and based on that, why I so appreciate David Webb.

Webb did a documentary on the Great Taking that might be of interest to some. The link to the video is here: Great Taking Documentary

You probably won’t understand a lot of the content covered in this video, but I do, and I have done my own vetting on the matter. Given that, this provision in the Uniform Commercial Code that provides for a roll up of the ownership of assets in the event the intermediary - a bank for instance - is declared insolvent is further support for my theory. In other words, not only will our money system change, but our ownership of assets that are encumbered by debt will result in the loss of those assets along with the cash we hold in these insolvent banks.

It kind of makes this statement by the World Economic Forum (WEF) a statement of fact and not just a statement reciting the vision they have for the future. Here is what they said:

Concluding comments

I believe all of this is coming and coming soon. I could be wrong, but the evidence to support my theory is substantial. There is no question on the matter of the Federal Reserve’s actions that created bank insolvency. A rate hike in the Fed Funds rate in excess of 5000% shocks the conscious of those who understand what that means. And there can be no question on the matter of the current language in the Uniform Commercial Code regarding what happens to our assets in the event of bank insolvency.

Mind you the world won’t end when all this takes place. It will change though - change a lot. We will become slaves to the system they put in place if we make that choice, and if we don’t, we will probably starve to death or freeze to death or meet our demise at the hands of a ruthless dictator who demands total loyalty and will not tolerate dissidents.

That said, if we do submit to this new system our eternal fate will be horrendous. I will tell you once again what the bible says on the matter:

And the third angel followed them, saying with a loud voice, If any man worship the beast and his image, and receive his mark in his forehead, or in his hand,

10 The same shall drink of the wine of the wrath of God, which is poured out without mixture into the cup of his indignation; and he shall be tormented with fire and brimstone in the presence of the holy angels, and in the presence of the Lamb:

11 And the smoke of their torment ascendeth up for ever and ever: and they have no rest day nor night, who worship the beast and his image, and whosoever receiveth the mark of his name.

That’s the bad news, but there is good news as well. This system will last for a brief period of 42 months. Those who die during this period will come back to life at the end of the 42 months. They will have immortal bodies and reign alongside Jesus for 1000 years. The bible says that in Revelation:

And I saw thrones and they that sat upon them, and judgment was given unto them. And I saw the souls of them that had been beheaded for the witness of Jesus and for the Word of God, and who had not worshiped the beast, nor his image, nor had received his mark upon their foreheads or on their hands; and they lived and reigned with Christ a thousand years.

Great article and you are right on with the probability of the digital currency going into affect and also the choice we will have to make regarding the “mark” of the beast and the punishment that will come upon us if we accept that mark and system. Thank you for bringing this plan to light , I have been searching and breaking down this system to come since the mid 70’s. May Yah bless you and keep you safe.

Thank you for this information