Irrefutable evidence that the Federal Reserve's monetary policies are leading the world in the direction of the biblical beast system.

Banks today are insolvent and this brief tutorial explains why that is.

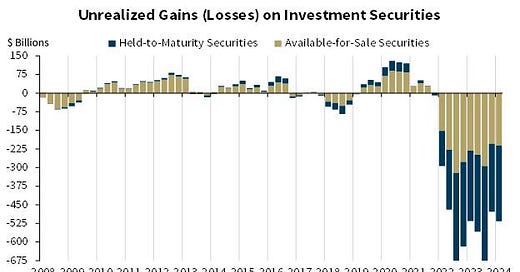

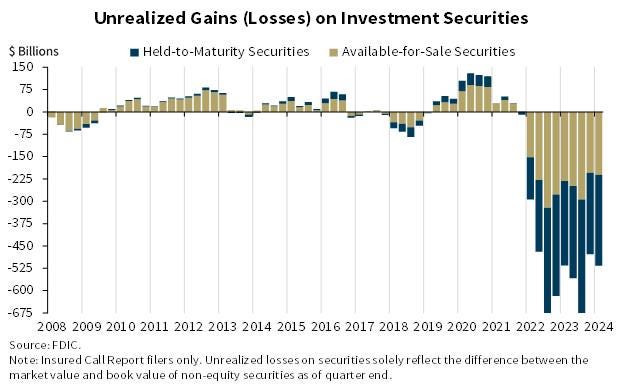

I recently wrote a paper dealing with US bank insolvency. I used a chart to show how the Federal Reserve’s monetary policy since 2022 has caused the value of bank owned assets - assets that should be sufficient to cover all bank liabilities - to drop in value precipitously since 2022.

In the world today hyperbole is often used to produce a state of panic, or at the least, high levels of anxiety, and so I think it useful to provide data that supports my position. I am not a “sky’s falling” sort of person after all - that is, unless I see concrete evidence that shows me the sky is falling.

In this post I want to provide a short tutorial of sorts in order to drive home my point, and my point is this - the Federal Reserve’s monetary policy since 2022 is pure evil. I confess to being a conspiracy theorist by the way. It is not a thing that should be disparaged - being a conspiracy theorist that is. A theory is defined as “a well-substantiated explanation of some aspect of the natural world, based on a body of facts that have been repeatedly confirmed through observation and experiment."

A body of facts matter, and I have a body of facts that make the point I want to make. We’ll get to those facts in a minute, but the point is this - the Federal Reserve’s interest rate policy has caused the value of assets held by banks to lose market value. Why that should concern you is simple enough. If the bank’s assets are less than their liabilities, then they would be unable to pay all their depositors the monies they owed them. In other words, you as a depositor are a creditor of the banks and so there could come a time where your bank is declared insolvent, and you would lose the money you have on deposit at that bank.

The facts I have are sufficient to support the theory that the Federal Reserve’s monetary policy since 2022 has caused the nations bank’s asset holdings to fall in value. Here is where the conspiracy part comes into play. My conspiracy theory is simple enough - the Fed’s policy was put in place to cause the banks to fail, to become insolvent.

Now I’ve crossed the line. I’ve set forth a hypothesis that wreaks of hyperbole. I really am saying the sky is falling - metaphorically of course.

Let me list of few of those facts:

In 1933 President Roosevelt declared a bank holiday shutting down the banks to stave off further panic withdraws of customer deposits.

In 1933 the Glass Steagall Act was passed for the purpose of separating investment banks from commercial banks that accepted customer deposits. Its intent was to make sure banks who took in deposits managed their cash in a way that was deemed low risk to prevent another bank failure.

Banks could invest their cash - cash derived from customer deposits - only in what the government deemed to be safe assets, i.e., US government debt.

The banks reopened a week after they were shut down, and the new plan gave depositors renewed confidence in banks.

Skip forward to 1999. President Clinton signed two seminal pieces of legislation. One - the Graham - Leach - Bliley Act that effectively repealed the Glass Steagall Act. Banks once again could deal in investments as well as accept customer deposits.

The second piece of legislation signed by Clinton was the Commodity Futures Modernization Act. In 2000 the Commodity Futures Modernization Act was passed for the sole purpose of establishing that banks would no longer be regulated. Banks began to deal in derivatives such as credit default swaps and interest rate swaps. These derivatives were essentially bets cloaked as hedges against risk, and the banks would take either side of the bet on these over-the-counter options. They effectively became the largest casinos in the world and remain so to this day with big banks holding positions in these derivatives in excess of $203 trillion. That number is over 10 times the dollar value of bank deposits, and these derivatives are held as off-balance sheet items.

One of the provisions in a fractional reserve banking system is required reserves. Banks since the passage of Glass Steagall had to maintain liquid reserves to ensure they had enough ready cash to meet depositor demands. In March of 2020 the Federal Reserve removed the requirement that banks hold liquid assets - i.e., required reserves.

In the last 24 years we’ve seen banking at the largest banks change dramatically. All the provisions designed to prevent another bank failure like the one in 1933 have been removed, and furthermore, these banks are no longer the traditional banking institutions they were prior to Bill Clinton’s complicity in creating a certain to fail at some point condition in the banking system.

Why, one might ask, would they do that? My answer - because they plan to collapse the current system and put a new system in its place. The timing is kind of iffy, but rest assured it will happen, and soon.

If you can find someone who will tell you the things I mentioned above I would be shocked. I’ve found people who touch on these issues, but they don’t really understand what has taken place. The subject matter really is extremely esoteric - that is, it’s simply not understood except by a very, very small number of experts in the field of money and banking. Certainly, our legislative branch doesn’t get it. And you’ll never hear investment advisors speak of these things, and for good reason, they don’t understand them either.

Moving on then, the most recent dastardly act on the part of those who have created just the right conditions needed to collapse the existing system and usher in the new system is the Federal Reserve’s interest rate policy since the Great Recession back in 2009. If you don’t understand how this stuff works, you’re not alone.

I’m going to provide a very sophisticated presentation of just how all this does work in this paper. We need to start with some fundamentals. First, we need to understand how bonds work - in particular government bonds, but the rules could apply to corporate bonds as well.

A bond is issued with a par value and a coupon rate. For our example we will use a 20-year $100,000 par value bond with a coupon rate of 4%. What that means is the bond will mature 20 years from date of issue and the holder of the bond will receive the par value of $100,000. Further, the holder of the bond will receive payments of 4% per annum for the duration of the bond. Those two things are certain - at maturity you get $100,000 and during the course of the 20 years you get payments of $4,000 per annum.

What’s not certain is the value of the bond over the course of the 20 years. The US Treasury is constantly retiring old bonds - called off-the-run bonds - and issuing new bonds called on-the-run bonds. These on-the-run bonds are sold at auction to primary dealers. Off-the-run bonds are bought and sold on the secondary market.

Banks are the primary dealer of these bonds, and also among the largest holders of the bonds. The following is a list of primary dealer banks taken from the New York Fed’s website:

ASL Capital Markets Inc.

Bank of Montreal, Chicago Branch

Bank of Nova Scotia, New York Agency

BNP Paribas Securities Corp.

Barclays Capital Inc.

BofA Securities, Inc.

Cantor Fitzgerald & Co.

Citigroup Global Markets Inc.

Daiwa Capital Markets America Inc.

Deutsche Bank Securities Inc.

Goldman Sachs & Co. LLC

HSBC Securities (USA) Inc.

Jefferies LLC

J.P. Morgan Securities LLC

Mizuho Securities USA LLC

Morgan Stanley & Co. LLC

NatWest Markets Securities Inc.

Nomura Securities International, Inc.

RBC Capital Markets, LLC

Santander US Capital Markets LLC

Societe Generale, New York Branch

TD Securities (USA) LLC

UBS Securities LLC.

Wells Fargo Securities, LLC

So back to the matter of current market value of off-the-run bonds. The market value of older bonds is determined by the coupon rate of on-the-run new issue bonds. If you owned a 4% coupon bond and new bond issues had a coupon rate of 5.5%, the bond you owned wouldn’t be worth as much as the one an investor could purchase a new bond for. The old bond with a par value of $100,000 and a cash stream of $4,000 annually would be worth less than a $100,000 bond paying $5,000 annually.

One way to determine the value of the 4% bond is to determine its NET PRESENT VALUE. I use the NPV function on Excel to arrive at the value. NPV simply takes the current rate of 5.5% and the cash stream of $4,000 and determines its current value relative to the new bond issue. The discount to par using these values is $18,684.66. In other words, an on-the-run bond would be worth $100,000 at date of issue (that is not always the case as the bonds are sold at auction, but practically speaking it is close) and the off-the-run 4% bond would be worth $100,000 - $18,684.66 = $81.315.34.

Now to the matter of the interest rate policy of the Federal Reserve. The Fed controls interest rates in two ways. They set the Fed Funds rate by policy action. It is the rate banks lend to other banks from their reserves and traditionally it was an overnight loan made to banks who didn’t have adequate levels of required reserves. Since the Fed removed reserve requirements it is merely a benchmark rate that the Fed controls directly based on the decisions made at the monthly FOMC (Federal Open Market Committee) meetings.

To better understand this rate, we can look at a Fed Funds rate chart:

The gray bars on the chart are periods when we were in recession. You will note the rate always moved higher until a recession occurred and then moved sharply lower after the recession started. This happened every single time we went into recession. The Fed raised rates eventually causing the recession and then dropped rates to bring us out of recession. Most see the Fed as reactionary. That is, they react when outside forces cause recessions. What you need to know is that is simply not true. They implement interest rate policies that ensure recession and then interest rate policies that bring us out of recession.

Another way the Fed controls interest rates has to do with the purchase and sale of US treasuries. Price of bonds are inversely correlated to interest rates. If you raise rates bonds go down and if you lower rates bonds go up. I demonstrated that truth when comparing a bond with a lower coupon rate than the rate a newer bond has. The Fed can buy bonds and drive price higher based on demand and that drives rates lower. The Fed’s checkbook has no limit so their ability to affect longer term rates via buying or selling bonds has no limit.

So, given that, let’s take a look at a yield curve at two different points in time:

This is what the yield curve looked like in November of 2020. The one-month rate was .09%. The 30-year rate was 1.57%. You want to know how the rich get richer. Consider in 2020 you could borrow 90-day money at a rate slightly above the 90-day rate on the chart above through a broker and use that money to buy 30-year treasuries at a yield of 1.57%. If the broker loan rate was .5% you would earn in profit the difference between the .5% loan rate and the 1.57% bond yield. In other words, you would be making 1.07% using borrowed money. Not such a big deal of course unless you consider leverage. If you use the right broker, you can get a 20 to 1 leverage on bond trades like this. A 1.07% yield times 20 is a 21.4% annual rate of return on your money. It’s called a carry trade - using short term low interest loans to buy long term high interest bonds.

There is risk involved though. The risk is that interest rates go higher. Two things happen in that case. The value of the bonds goes down and the cost to borrow goes up. If you could carry the trade to maturity, you would be OK but the bonds you control will lose value as rates go up and those bonds back the loan you used to buy them with so suddenly you have to exit the trade at a loss or come up with money to offset the drop in bond price. Of course, you could buy protection against a shift in interest rates - an interest rate swap - from one of the big banks dealing in these over-the-counter custom-tailored derivatives.

If you were to mention that sort of trade to your local Charles Schwab or Vanguard broker good luck. They won’t in all likelihood have the vaguest idea what you are talking about and certainly won’t be able to accommodate you in putting such a trade on. The point though is this is pretty close to the sort of trade big banks have on with their own cash. When you deposit your money in the bank the money becomes the banks money to do with as they wish. They owe you for that money of course, but it is not held in trust for you, but rather you have access to it via your bank account.

The banks take your money and uses it to buy securities - US treasuries for instance. And they do use leverage thus increasing risk of loss. The following chart reflects the dollar value of US treasuries held by banks:

At the beginning of the Great Recession in 2008 banks held a little over $1 trillion in these securities, but things changed after that. The federal Reserve started buying securities in what is referred to as a repo from the banks. The banks received cash credit for the securities and used those funds to buy more securities of the exact same type they sold to the Fed. The effect was to produce the biggest bull market in bonds we’ve ever seen, and also to pave the way for a massive increase in US government debt levels. As the level of treasuries held by banks went up so too did the level of treasuries held by the Federal Reserve:

Of note is the fact that the Feds holding of US treasuries really surged starting in 2020 and it is no coincidence that was the time the US government engaged in the most irresponsible and irrational response to what I say is a false flag pandemic the country has ever seen. Federal debt levels took off for the moon and about 30% of those debt instruments are in the hands of the banks and the Federal Reserve.

I love charts. They tell me all I need to know in order to put the pieces of the puzzle together and make sense of it so let’s look at another one - Federal debt levels:

Are we to believe this is a product of incompetence? Really? When you begin to look at all the pieces of the puzzle it reveals to you a level of unprecedented competence - not incompetence. You just have to know the plan these people are implementing, and once you know the plan you also recognize the genius behind the plan’s implementation. Mind you it is an evil plan, but evil geniuses do exist.

Equally important is the fall in treasury holdings by the banks and the Fed starting in 2022 when the Fed began to raise interest rates. Remember, when interest rates go up the value of the bonds go down. Let’s look at another chart. Let’s take a look at the treasury yield curve in November of 2022 and compare it to the 2020 yield curve above:

The one-month yield went from .09% to 4.16%. That is an increase of 4522% in the one month over a span of just 2 years. Let’s look at the 10-year rate. In 2020 the 10 year was at .88% and in 2022 it was at 3.68%. That’s an increase of 388%. Not nearly as dramatic as the one month, but still it had an impact on the value of off-the-run treasury bonds held by banks. We can run a net present value calculation to get an idea of the magnitude of the discount from par this had on 10-year treasuries. The discount to par would be $24,642.68 so the off-the-run 10-year issued in 2020 would be discounted by that amount from par: $100,000 - $24,642.68 = $$75,357.32.

Consider that a bank who purchased 10-year treasuries in 2020 with bank cash they received from customer deposits has a current market value of $75,357.32 and the bond would have cost the bank $100,000. That loss is seriously problematic for banks in the event of a bank run - the sort of thing that happened in the early 1930’s.

The banks will be just fine if everybody leaves their money in the banks, but with that said, it is easy to create a bank run if that is the plan in the first place. We saw that with Silicon Valley Bank about 18 months ago. Peter Thiel shouted the alarm and the run started. Consider this excerpt from an article titled Silicon Valley Bank: A Lesson in the Power of Online Narratives:

Following the news of SVB’s losses, on Thursday, Peter Thiel, a billionaire entrepreneur and venture capitalist with a devoted following, told his portfolio companies that they should pull their money out of SVB, igniting panic within the venture tech Twittersphere and arguably accelerating the bank run. And he wasn’t the only one. For example, popular financial expert Genevieve Roch-Decter tweeted, “Silicon Valley Bank $SIVB is in trouble. It sold off a $21 billion bond portfolio for a huge loss to shore up liquidity. The market is worried and the stock is down 54% today. Here’s what you should know.” Meanwhile, Kate Clark, Senior Reporter at The Information, tweeted about how VCs were advising founders to limit the amount of cash they were keeping in SVB.

It sold off a $21 billion bond portfolio for a huge loss to shore up liquidity the article states. A huge loss indeed, and why did the bank suffer such a huge loss in the treasuries they had invested in - all in accord with what is deemed to be good business practice and is a part of commercial banking protocol? The answer has been explained in this paper. The answer is the Fed’s monetary policy regarding interest rates and the impact those policies have on bonds - bonds held by banks as collateral assets needed to protect investor deposits.

Are we to believe this was a one-off situation? Hell no!!! Silicon Valley Bank was a good bank and followed the rules. My own theory - Silicon Valley was a beta test. Kind of a let’s crash a few banks to see what the fallout will be before we pull the plug on the whole system. Silicon Valley was big and so garnered most of the headlines, but Silvergate Bank and Signature Bank also failed in March of 2023.

There is so much more I need to say, and will say over time, but I think I’ll end this short tutorial here with this comment - I think it’s important that we all understand what has taken place over the last 25 years - things that almost nobody understands, but things that, even though they are inimical to the interest of the people, are happening by design.

There is an agenda in place after all, and it is a conspiracy, but not a theory. Those who are implementing this agenda are extremely powerful and wealthy people - people who for the most part hide in the shadows. One of those people who didn’t hide in the shadows was David Rockefeller. Rockefeller died in 2017 at the age of 101. He was the Chairman and CEO of New York based Chase Bank. To say David Rockefeller was a powerful and wealthy man would be an understatement. He was an heir to the Rockefeller wealth and the patriarch of the Rockefeller family in his later years. He published a book shortly before he died - Memoirs by David Rockefeller. The following is a quote from the pages of his book:

“For more than a century, ideological extremists, at either end of the political spectrum, have seized upon well-publicized incidents, such as my encounter with Castro, to attack the Rockefeller family for the inordinate influence they claim we wield over American political and economic institutions. Some even believe we are part of a secret cabal, working against the best interests of the United States, characterizing my family and me as 'internationalists,' and of conspiring with others around the world to build a more integrated global political and economic structure - one world, if you will. If that's the charge, I stand guilty, and I am proud of it.

One more thing he had to say, and he had a lot to say, is this quote back in 1991:

“We are grateful to the Washington Post, the New York Times, Time Magazine and other great publications whose directors have attended our meetings and respected their promises of discretion for almost 40 years......It would have been impossible for us to develop our plan for the world if we had been subjected to the lights of publicity during those years. But, the world is more sophisticated and prepared to march towards a world government. The supernational sovereignty of an intellectual elite and world bankers is surely preferable to the national autodetermination practiced in past centuries.”

Rockefeller is telling us this plan goes back to 1951. And the plan is to take control of the entire planet and put intellectual elites and world bankers in charge of things. He also admits major news organizations were complicit in that they attended the meetings of these globalists and remained silent. If you think the major news outlets are propagandists today as I do, then at least a little bit of proof was offered to us by Rockefeller when he praised these various news organizations for keeping quiet. Does that not wreak of a conspiracy? Secret meetings to plan and implement a takeover of the whole world by bankers?

I’ll close this paper the way I opened it:

In the world today hyperbole is often used to produce a state of panic, or at the least, high levels of anxiety, and so I think it useful to provide data that supports my position. I am not a “sky’s falling” sort of person after all - that is, unless I see concrete evidence that shows me the sky is falling.